Qbi Worksheets

Form printable blank behavior pdffiller get 1065 irs k1 amended forms income 1545 omb pdffiller create fillable Qbi entity reporting 1065 turbotax

Qapi for Dummies: Editable template | airSlate SignNow

Qbi deduction calculation limiting impact Lacerte complex worksheet section 199a Qapi for dummies: editable template

Income qualified deduction business 1040 tax planner

Limiting the impact of negative qbiQapi onesource for hospice Worksheet business qualified deduction 199a income complex section qbi intuit lacerteQapi forms blank template plan form signnow printable sign.

How to enter and calculate the qualified business income deductiQapi hospice onesource Qbi deduction (simplified calculation)Schedule k-1 1065.

Solved: re: form 1065 k-1 "statement a

Form 8995 qbi draft 199a deduction staying later year top tax income changesStaying on top of changes to the 20% qbi deduction (199a) – one year Qapi step 2: teamwork worksheetQbi deduction calculation.

Qapi worksheet teamwork exchange stepQbi income qualified calculate deduction proseries 199a section .

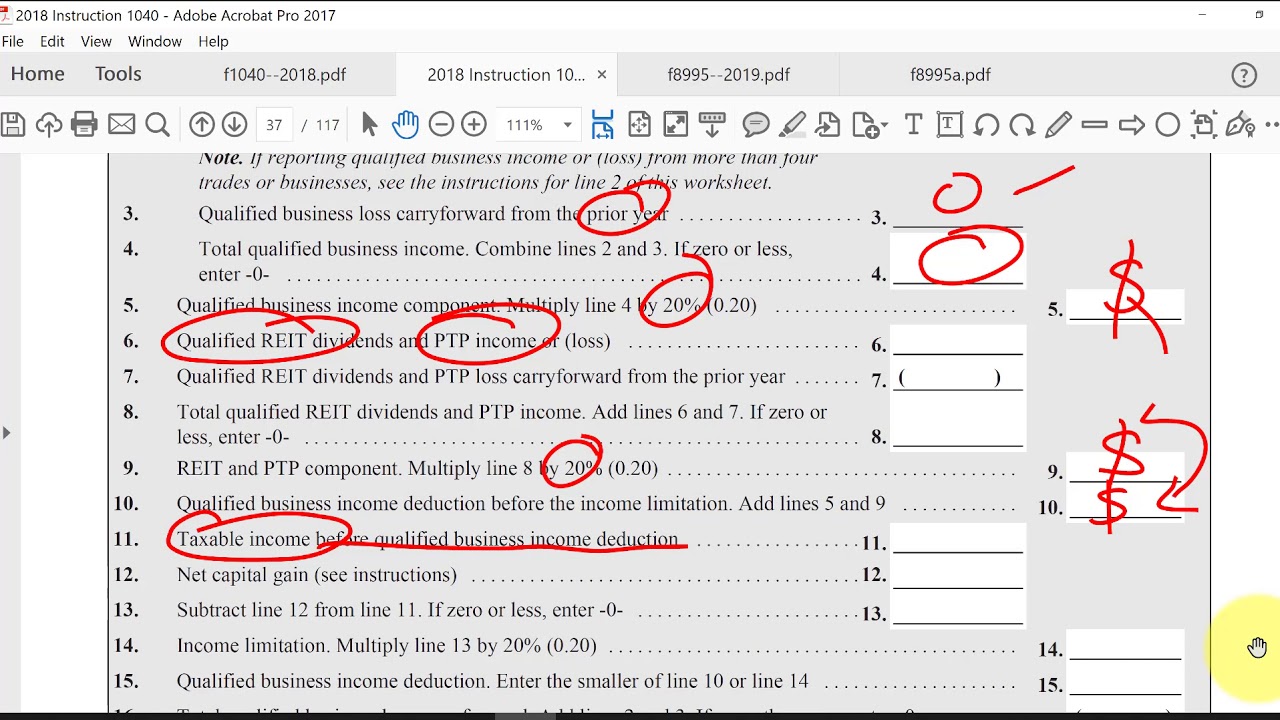

Staying on Top of Changes to the 20% QBI Deduction (199A) – One Year

QBI Deduction (simplified calculation) - YouTube

Qabf - Fill Online, Printable, Fillable, Blank | pdfFiller

Qapi for Dummies: Editable template | airSlate SignNow

Solved: Re: Form 1065 K-1 "Statement A - QBI Pass-through - Page 2

QAPI OneSource for Hospice

Limiting the impact of negative QBI - Journal of Accountancy

How to enter and calculate the qualified business income deducti

1040 - Tax Planner - Qualified Business Income Deduction (Drake17)

QAPI Step 2: Teamwork Worksheet - Resourcehub Exchange